President Yoon presented SKorea's vision for hosting World Expo 2030 in Busan in BIE, highlighting the nation's strength in culture, digitalization, green technology and its commitment to a shared future at the final presentation session held in Paris. In his speech, Yoon stressed the country's will to make the exhibition a platform to address most pressing challenges the world is facing, both at present and in the future, and that Asia's fourth-largest economy is a qualified candidate to host the event. He said Korea is fulfilling 1,258 ODA projects with member states of the BIE. Yoon said Korea is committed to providing the largest ever assistance package for more than 110 member states that are participating. Addressing country's experience of hosting global events including 1993 Daejeon Expo, 2012 Yeosu Expo, 1988 Summer Olympics, 2002 FIFA World Cup and 2018 Winter Olympics, Yoon said Korea is united and Busan is ready.

SKorea lifted nearly all COVID-19 restrictions on 1st, including isolation mandate for COVID-19 patients. On May 11th, President Yoon declared that the government would downgrade status of COVID-19 crisis from "serious," the highest level, to "alert". With alert level lowered, COVID-19 isolation period of seven days has been shortened to five days and is no longer compulsory. Indoor mask mandates have now been lifted in almost all places, including clinic-level medical institutions and pharmacies. But the mandate will remain at hospital-grade or higher medical institutions. Recommendation for taking a PCR test within three days of arrival here from abroad has been lifted. All seven COVID-19 temporary screening test centers in the country, including one located outside Seoul Station, have suspended their operations. But regular screening clinics located at public health centers will continue to operate and offer PCR tests. Free COVID-19 vaccinations and medication will continue to be provided.

Japan is putting SKorea back on its ¡°whitelist¡± of trusted trading partners, marking end to a trade dispute that had dragged on for four years, as two sides have renewed commitment to improve bilateral economic ties. Japan¡¯s Ministry of Economy, Trade and Industry announced on 27th it has decided to redesignate Korea as a "Group A" country, returning to Seoul the preferential export treatment it had enjoyed until 2019. Japanese government decided to partially revise the Export Trade Control Order based on the Foreign Exchange and Foreign Trade Act to add SKorea to the whitelist. After being promulgated, the amendment will come into force from July 21st. Read More¡¦

SKorea reported trade surplus of $1.13 bil in June, for the first time in 16 months, but its outbound shipments fell for ninth consecutive month due mainly to weak demand for semiconductors. Outbound shipments fell 6% on-year to $54.24 bil, as exports of semiconductors sank 28% on falling demand and a drop in chip prices. Exports of petroleum products and petrochemicals also dived 40.9% and 22% on-year, respectively, on falling prices. But car exports spiked 58.3% on-year, and global sales of ships soared 98.6%. Overseas shipments of secondary batteries also climbed 16.3% in June. Imports fell 11.7% on-year to $53.11 bil in June, as energy imports went down 27.3% on-year.

SKorea's foreign reserves came to $421.45 bil as of end-June, up $470 mil on-month, as the dollar's fall boosted the conversion value of holdings in other currencies and increased deposits, according to Bank of Korea. Foreign securities had been valued at $375.64 bil, down $3.3 bil on-month, accounting for 89.1% of foreign reserves. The value of deposits stood at $21.56 bil, up $3.74 bil on-month. SKorea ranked as world's ninth-largest holder of foreign reserves as of end May.

SKorea's consumer prices rose 2.7% on-year in June, falling below 3% for the first time in 21 months, according to Statistics Korea. Prices of utility services continued to grow sharply, advancing 25.9% over the period, as Korea Electric Power Corp raised its bills amid fluctuations in global energy prices. Prices of agricultural, fisheries and livestock products edged up 0.2%, following higher costs of apples and chicken, which rose 11.1% and 13.7%, respectively. Industrial product prices increased 0.2% on-year, led by higher costs of bread and children's clothes. Gasoline and diesel, on the other hand, fell 23.8% and 32.5%, respectively. Core inflation rose 3.5% on-year in June.

The collective orderbook of Korean Big3 has reportedly reached KW150 tril ($114.6 bil). With future delivery slots filled with orders, shipbuilders are starting to cherry-pick profitable orders. A robust upward trend in newbuilding prices, with expectations of ship dismantling and replacement order cycle, driven by environmental regulations, has infused pervasive sense of positivity throughout the industry. As of end May, remaining orders for Big3 stood at 442 units or $55.578 bil for HD KSOE(offshore plants excluded), 148 units or $30.1 bil for SHI, 131 units or $28.95 bil for Hanwha Ocean.

Hanhwa Ocean started to hire new employees for the first time in the name of Hanhwa Ocean. The company plans to recruit a large number of high talents in almost all divisions including Sales/Business management, Financial, Strategic planning, and Personnel affairs as well as shipbuilding, R&D, and design. It plans to normalize Hanwha Ocean's shipbuilding and design capabilities as soon as possible through big recruitment, especially in construction and design sectors, where the company had seen much outflow of workers. Read more¡¦

Hanwha Group's acquisition of DSME will lead to increased competition among Korean Big 3 once more. Until COVID-19, competition between the three companies seemed somewhat loose due to order drought resulted from recession and failure of HD KSOE to acquire DSME. However, the situation has now changed. The shipbuilding atmosphere in the market has completely changed with the official launch of Hanwha Ocean. First of all, Hanwha Ocean's large-scale investment is noticeable. The company expressed their intention to hire large number of highly skilled professionals in various areas such as production, research and development, design, sales, business management, finance, strategy, and human resources. Read more¡¦

-------------------------------------------------------------------------------------------------------

ATTACHMENT: Korea Report - June 2023 (PDF FILE)

Please let us know if you have difficulty opening the file.

|

IMPORTANT INQUIRY.

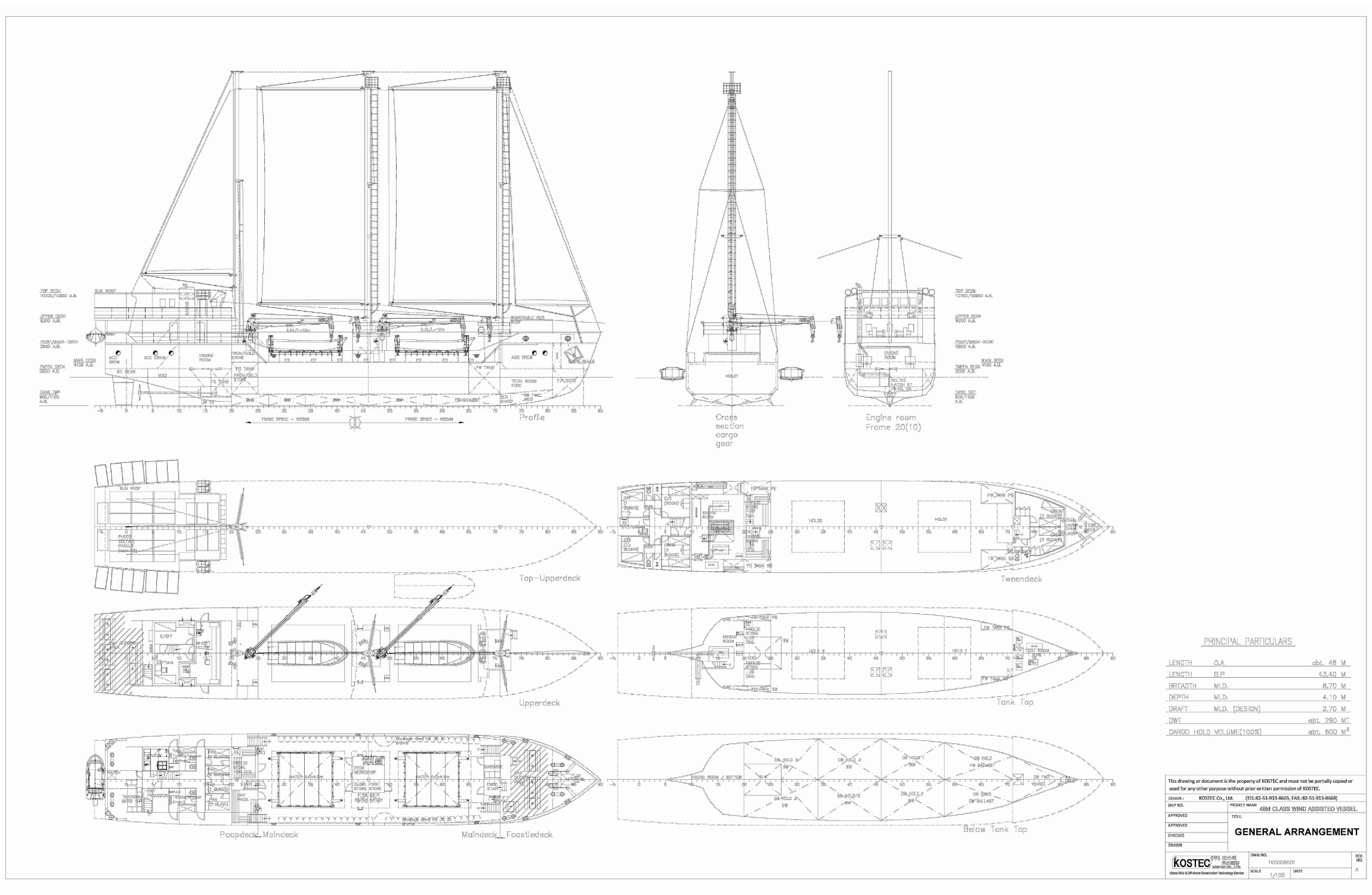

48M CLASS WIND ASSISTED VESSEL.

We have recently been involved in the project which was developed for the islands in the clean water. It is eco-friendly concept combined with most efficient engine with sails, which is ideal for the transportation/commute among the islands in protection of environment.

PRINCIPAL PARTICULARS.

LENGTH : ABT. 48M

BREADTH : 8.70M

DRAFT(DESIGN) : 2.70M

DWT : ABT. 290 MT.

CARGO HOLD VOLUME(100%) : ABT. 600M3

SPEED : 8 KNOTS AT 90% MCR

PASSENGER : 6 PERSONS

WIND PROPULSION : MASTS (3), SAILS(4)

MAIN ENGINE : FOUR-STROKE, NON-REVERSIBLE,

DIRECT FUEL INJECTION, ELECTRIC STARTING, TURBO CHARGED,

HIGH SPEED DIESEL ENGINE. ABT. 260 KW AT 100% MCR

Detailed information ready upon firm interest.

Hwang & Company, Ltd.

hwangnco@hwangnco.com

|